san antonio sales tax rate 2019

0250 San Antonio ATD Advanced Transportation District. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

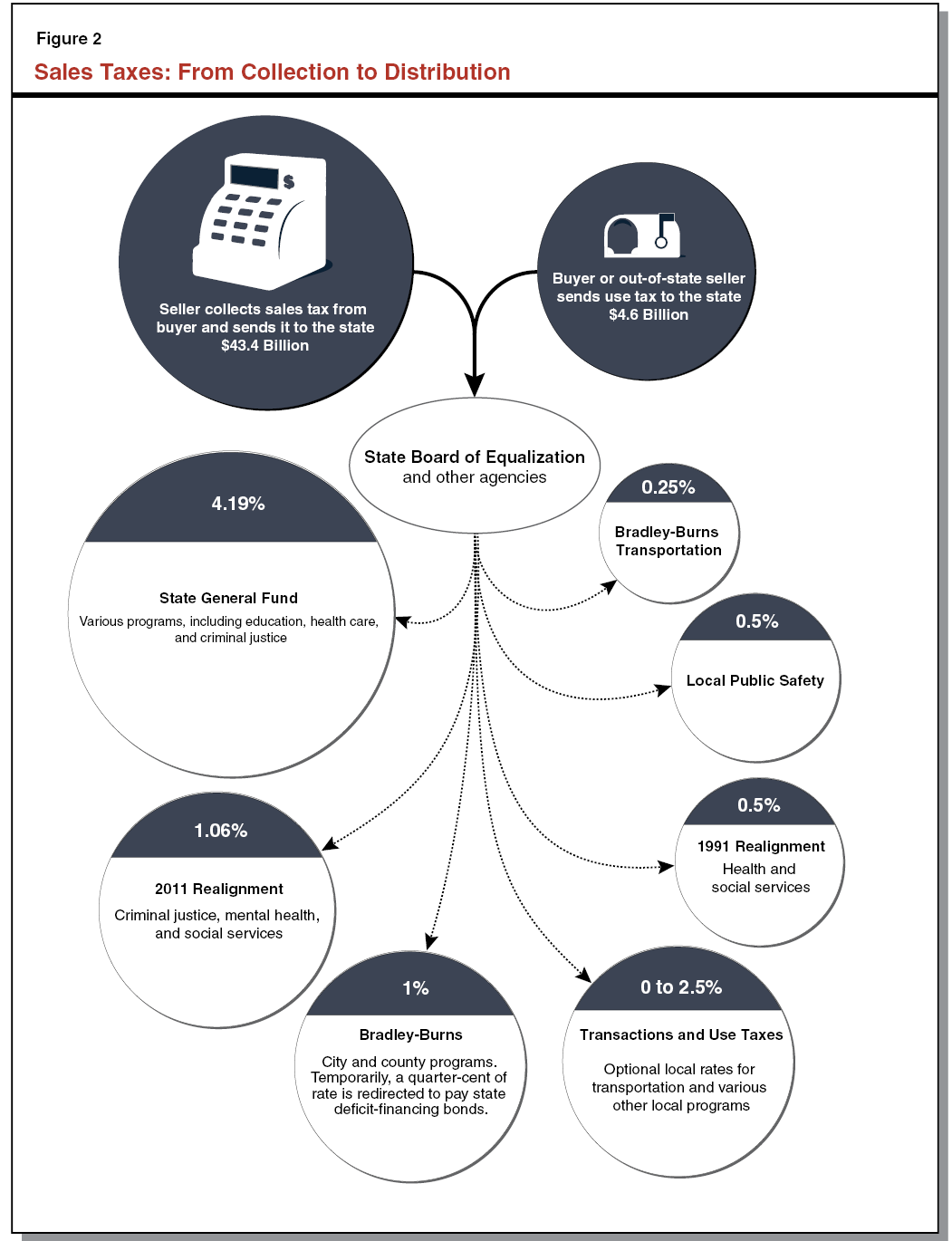

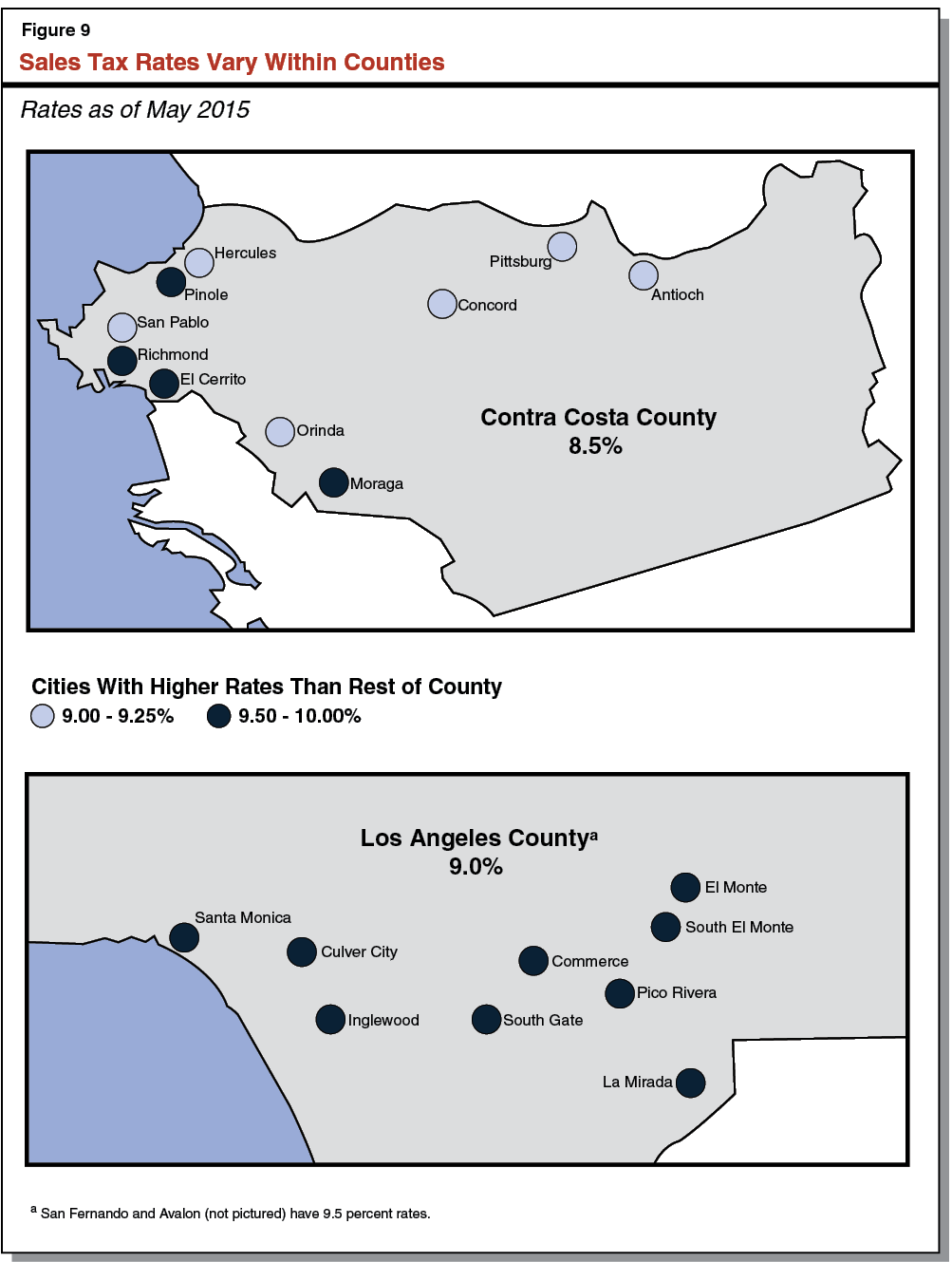

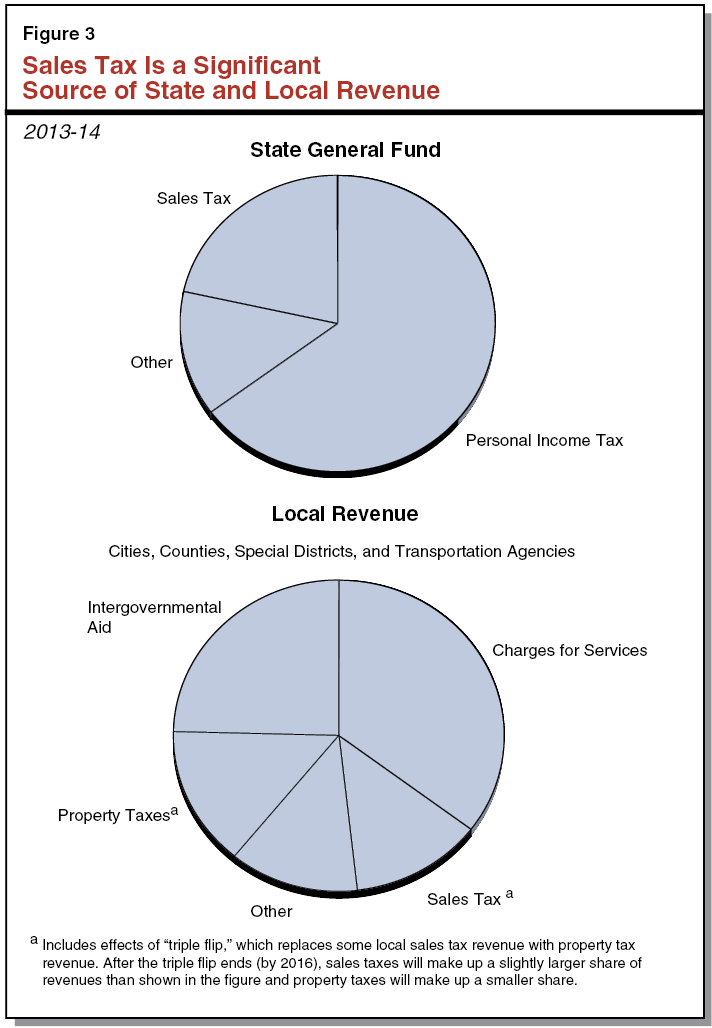

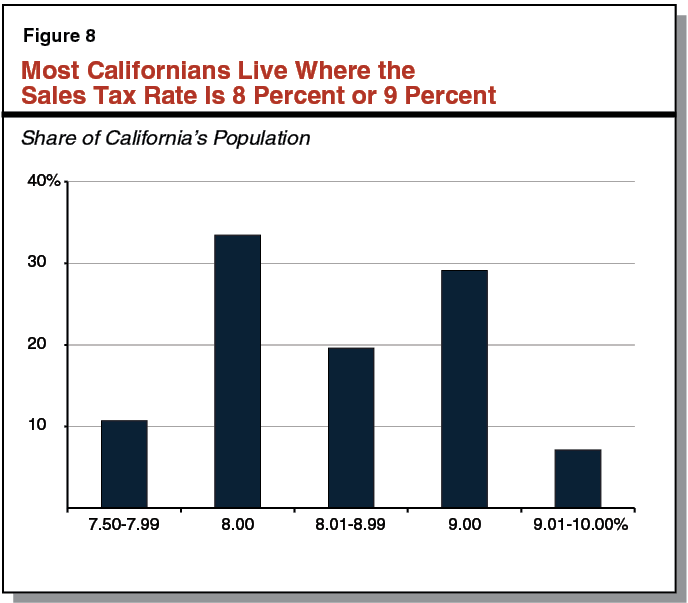

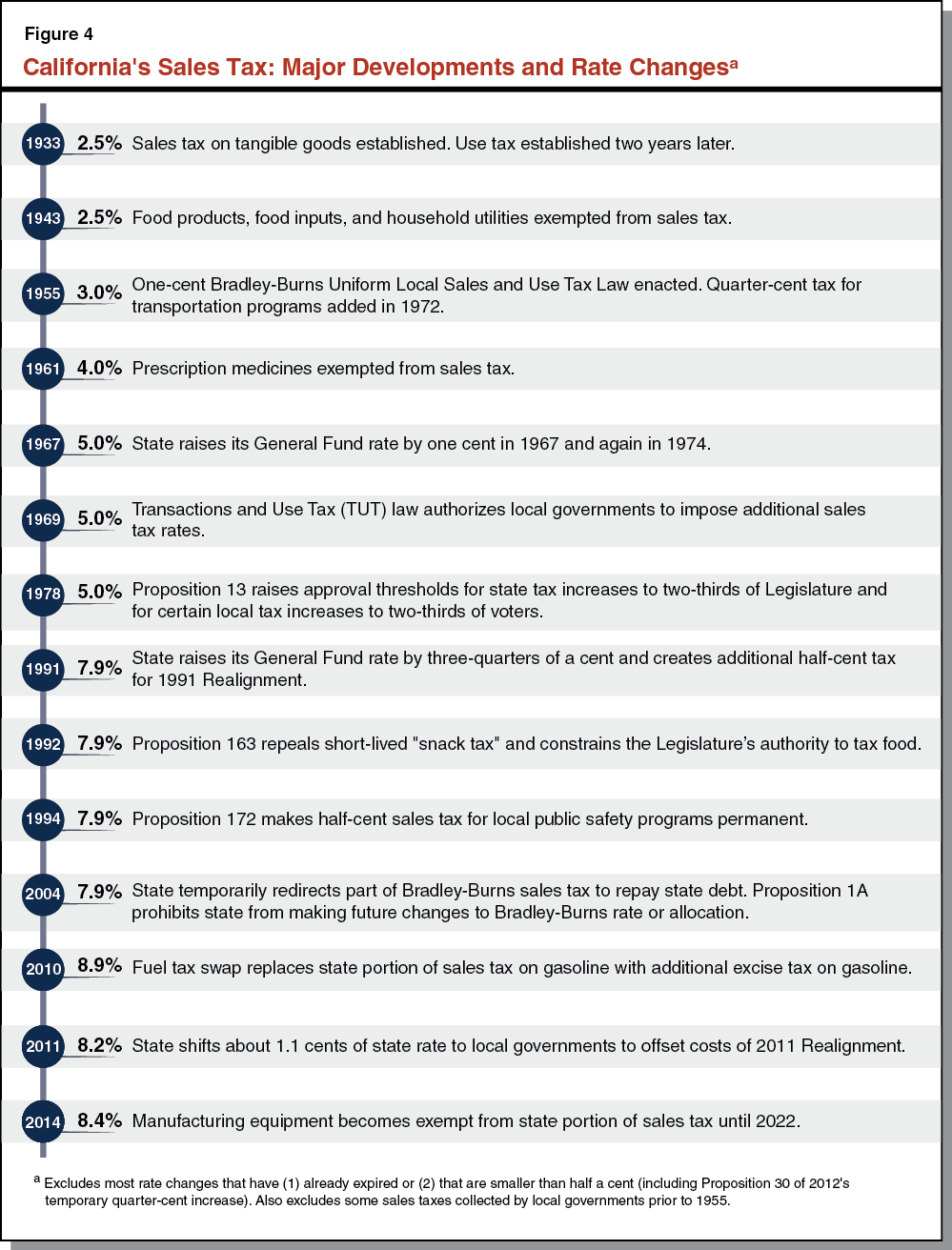

Understanding California S Sales Tax

View the printable version of city rates PDF.

. 0500 San Antonio MTA Metropolitan Transit Authority. Download city rates XLSX. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax.

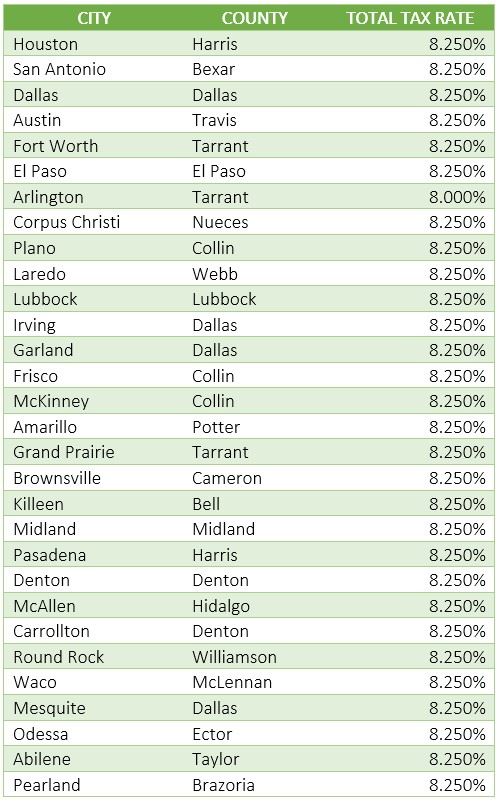

6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax. For tax rates in other cities see Florida sales taxes by city and county. 0250 San Antonio ATD Advanced Transportation District.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The San Antonio sales tax rate is. City sales and use tax codes and rates.

2019 Official Tax Rates Exemptions. Up to 24 cash back San antonio texas sales tax rate 2019 San Antonio Texas knows how to party. 2018 Official Tax Rates Exemptions.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. San Antonio has parts of it located within Bexar County and Comal County. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

This is the total of state and county sales tax rates. Bexar Co Es Dis No 12. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. The Texas sales tax rate is currently. 127 rows Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest.

Within San Antonio there are around 82 zip codes with the most populous zip code being 78245. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. Did South Dakota v.

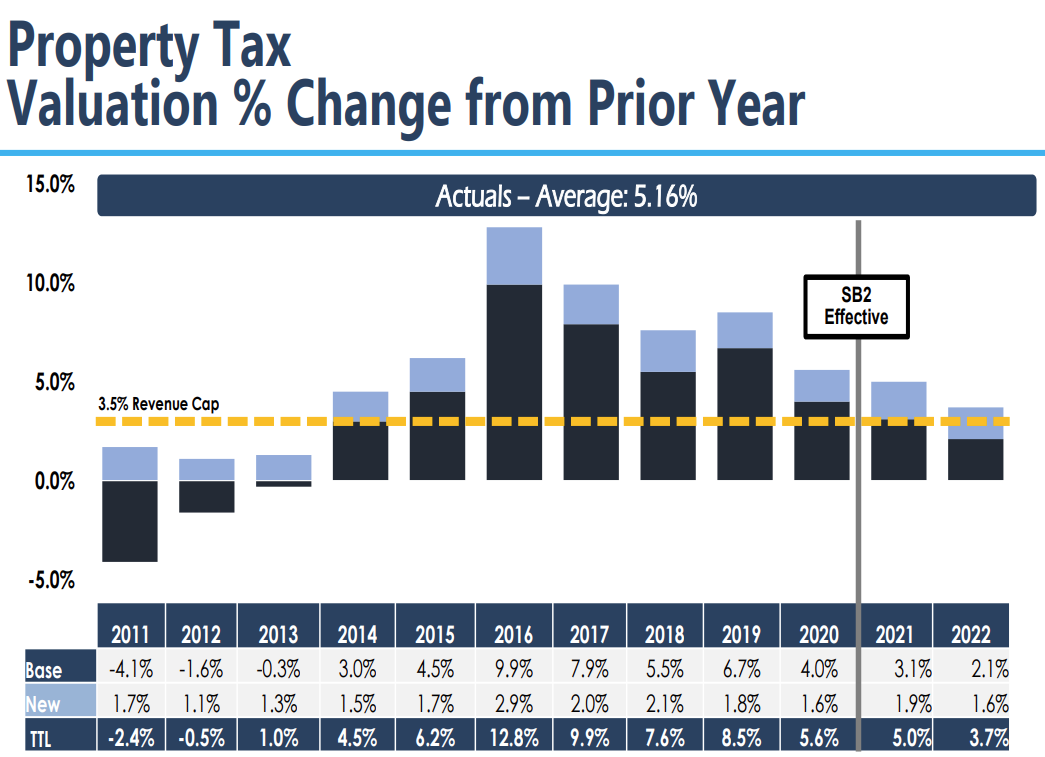

The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8. The December 2018 total local sales tax rate was also 8250. San antonio property tax rate 2019.

The Texas state sales tax rate is currently 625. It does a whole Fiesta Week. With local taxes the total sales tax rate is between 6250 and 8250.

1000 City of San Antonio. Contents Local sales taxes. 0125 dedicated to the City of San Antonio Ready to Work Program.

1000 City of San Antonio. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

This is the total of state county and city sales tax rates. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates. This includes the rates on the state county city and special levels.

San Antonio collects the maximum legal local sales tax. The minimum combined 2022 sales tax rate for San Antonio Texas is. There is no applicable city tax or special tax.

The 825 sales tax rate in san antonio consists of 625 texas state sales tax 125 san antonio tax and 075 special tax. The current sales tax rate in San Antonio Texas is 783 percent. Sales Tax In San Antonio Texas 2019.

There is no applicable county tax. The Bexar County sales tax rate is 0. The San Antonio sales tax rate is a rate of tax a consumer must pay when purchasing goods and some services in Bexar County Texas and that a business must collect from their customers.

The minimum combined 2022 sales tax rate for Bexar County Texas is 825. San Antonio TX 78205 Phone. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. Depending on the zipcode the sales tax rate of san antonio may vary f How 2016 sales taxes are calculated in san antonio.

The County sales tax rate is. The Bexar County sales tax rate is 0. The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate.

4 rows The current total local sales tax rate in San Antonio TX is 8250. The base state sales tax rate in texas is 625. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

This rate includes any state county city and local. 2018 rates Zip code 78216 2019 sales tax fact 89 zip codes Special sales tax San antonio turned The latest sales tax rate for San Antonio TX. What is the sales tax rate in San Antonio Texas.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The Texas sales tax rate is currently. The sales tax jurisdiction name is san antonio atd transit which may refer to a local government division.

You can print a 7 sales tax table here. City Sales and Use Tax. San Antonios current sales tax rate is 8250 and is distributed as follows.

The base San Antonio Texas sales tax rate is 125 the San Antonio MTA Transit tax is 05 and the San Antonio ATD Transit rate is 025 so when combined with the Texas sales tax rate of. Texas Comptroller of Public Accounts. The average cumulative sales tax rate in San Antonio Texas is 822.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Why Are Texas Property Taxes So High Home Tax Solutions

Texas Sales Tax Guide For Businesses

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

Realtor Selling House Tax Deductions Selling Your House

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Understanding California S Sales Tax

Understanding California S Sales Tax

Sales Tax Rates In Major Cities Tax Data Tax Foundation

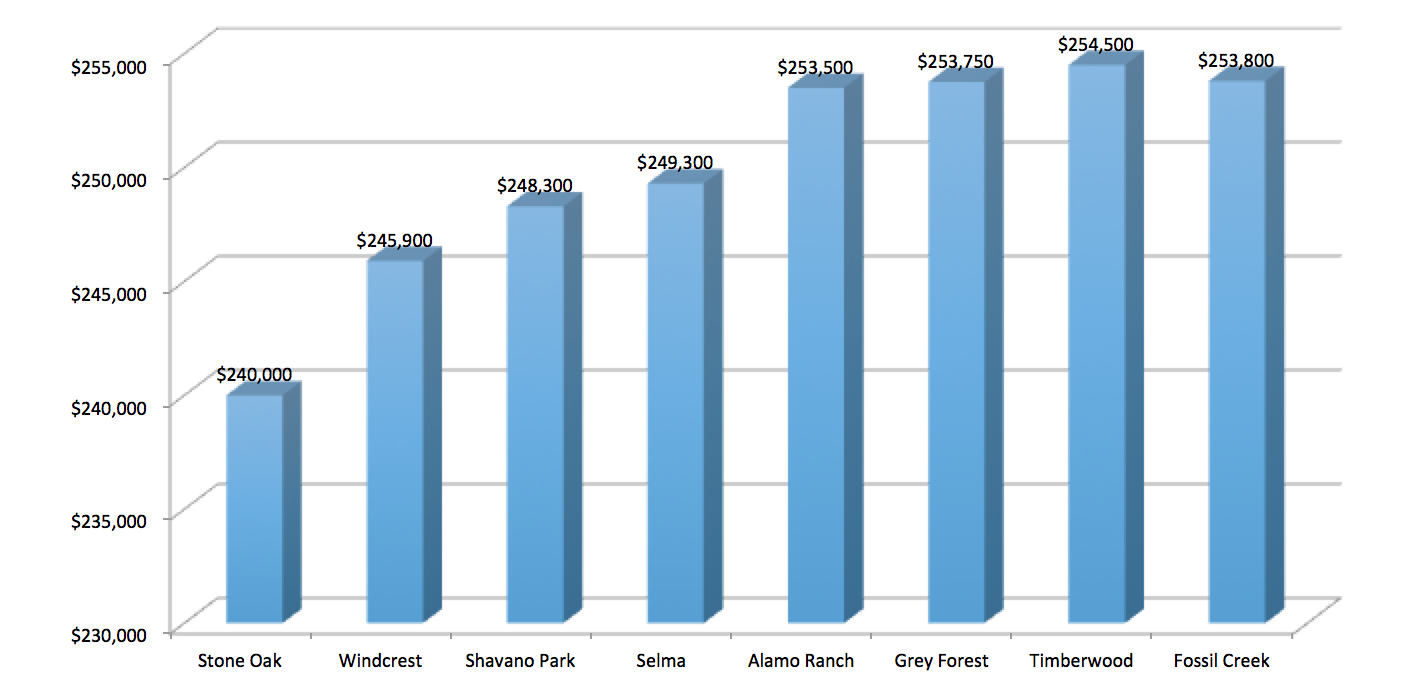

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket